I have partnered with Life of Dad and Capital One for this campaign, but my opinions are my own.

Well here we are three weeks into 2017 and I haven’t made any real resolutions to speak of. Sure, I did the customary “I’ll drink less wine” (declared over a glass of wine) and “I’ll exercise more” (sworn from a couch I was sunken into), but nothing new or potentially life-changing was in the works for me. That is, until I started checking my Vantage 3.0 credit score with CreditWise® from Capital One®. I noticed, happily, that my credit score had gone up a bit recently! That was without me focusing on improving it at all. I decided that my resolution for this month, at least, would be to actively take some steps to improve my credit MORE.

I haven’t really paid very much attention to my credit score before. I mean, I SHOULD have, but I didn’t. I took the “what I don’t know won’t hurt me” approach which really isn’t a very solid strategy. I spent a lot of my early- to mid- and possibly late-20’s being blissfully unaware of my bill payment schedules. Bills were always just an arbitrary thought, an apparition of a place that my money might land. Nothing like the concrete tangibles that I could spend it on like a new surfboard or a weekend away with friends…important stuff like that. I’d square my bills all away eventually, but I didn’t quite see how the timeliness of those would be a benefit to me down the line. So my credit took some well-deserved hits thanks to my ill-advised decisions. These days I’m a solid “good” when it comes to credit scores, but I could be doing so much better.

When I started using CreditWise, I was pretty excited to access my score any time I wanted without penalty. Right away, I noticed some weird stuff. According to my TransUnion credit report, I’ve been homeless since 2008 and am apparently homeless in Arizona—a state I haven’t lived in for almost a decade and have never been homeless in! Years of timely payments on credit cards, car loans, rent, and utilities were missing—something I wouldn’t have known without checking my credit report summary on CreditWise.

Despite this, I was managing OK, but now I want to do more than just get by. I want to actively improve my score every day and ensure I have the resources I need. This means making decisions that provide a safety net for emergencies or when applying for a loan. Whether it’s securing a non collateral loan for unexpected expenses or just feeling more secure for my family’s future, I’m committed to enhancing my credit profile. Plus, improving my score might even bring me closer to finally owning the high-end sports car I’ve always wanted.

Take a look at how easy it is to see an overview of your credit health with CreditWise (which is super important for lenders as I inch closer to that sports car!)

https://www.youtube.com/watch?v=LuM0cfn9e-0

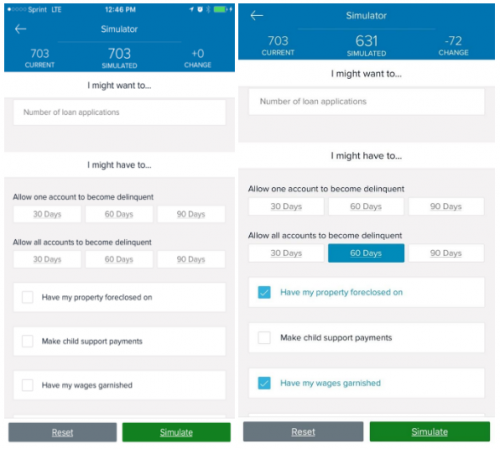

So this month, I’m going to be using CreditWise and the credit simulator to learn what I can do to make my credit better (take a look at the pictures that show that massive drop if I go delinquent on payments for a while!).

With good monitoring and making the right moves daily, maybe I’ll creep up to a higher score inch by inch! I challenge all the readers of Life of Dad to download the app (it’s completely free, even for non-customers!), take a look at your score and learn how to improve it. After all, if you’re a father, like I am, your credit score isn’t just affecting you anymore, but your entire family. So enroll, learn what to do and join me this month as we push our scores up and create a bit more financial stability for ourselves.

Learn more about CreditWise with this short video:

https://www.youtube.com/watch?v=UE3xYkskgx8